Global LNG demand is increasing

Source: METI, LNG Producer-Consumer Conference, June 2025

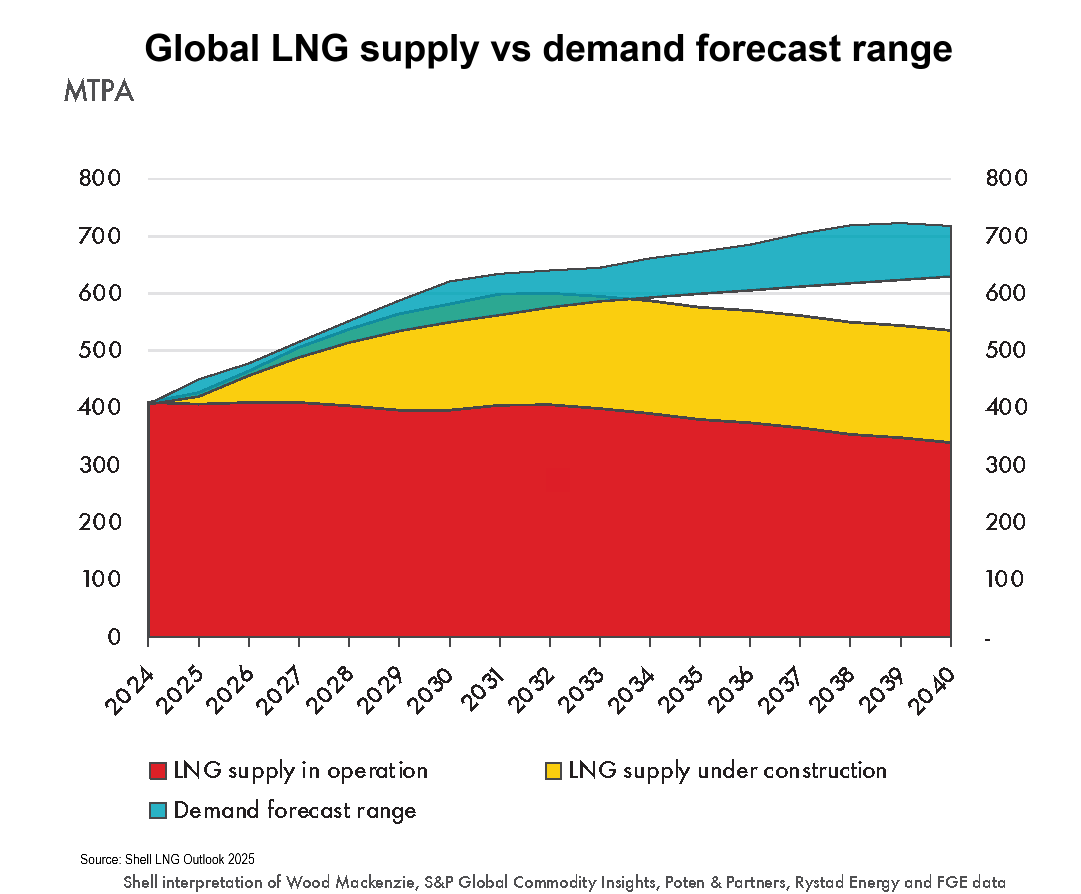

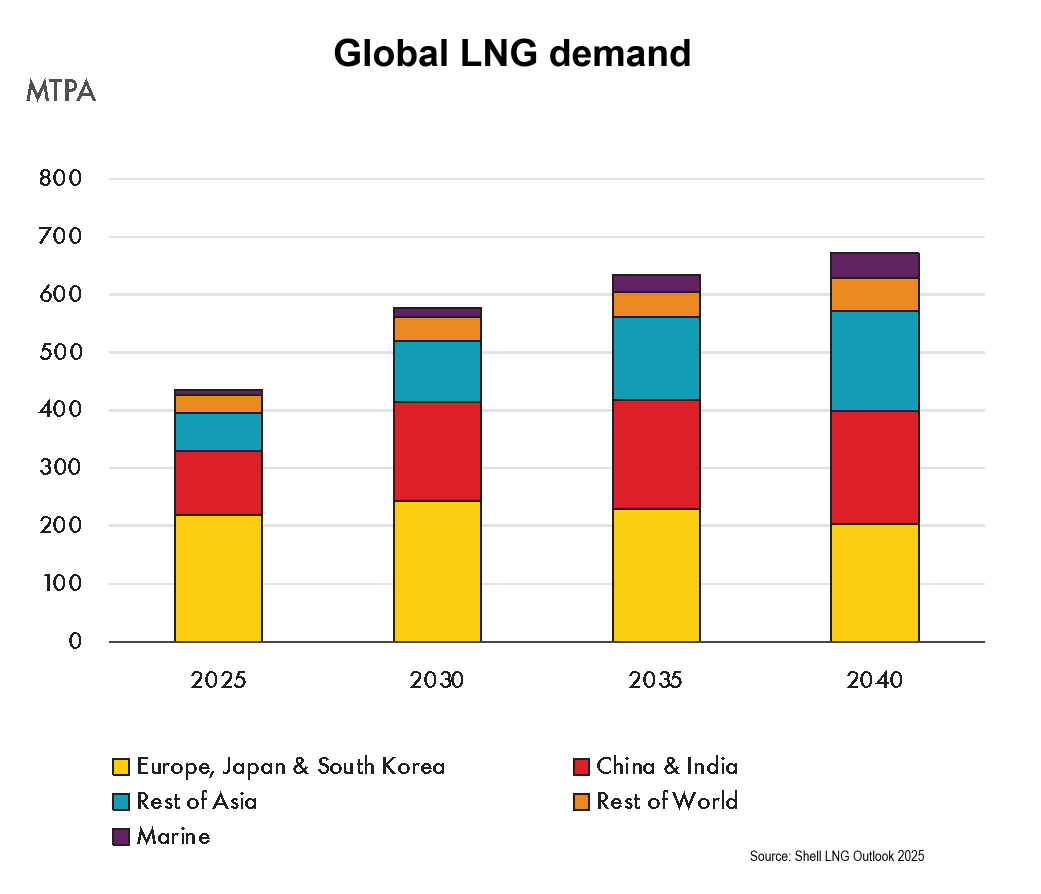

Shell’s LNG Outlook 2025 forecasts demand for liquefied natural gas (LNG) will rise by around 60% by 2040 (refer to chart above, left), largely driven by economic growth in Asia, emissions reductions in heavy industry and transport as well as the impact of artificial intelligence. Industry forecasts now expect LNG demand to reach 630-718 million tonnes a year by 2040, a higher forecast than last year. More than 170 million tonnes of new LNG supply is set to be available by 2030, helping to meet stronger gas demand, especially in Asia, but start-up timings of new LNG projects are uncertain. Shell also expect a continuing global LNG supply shortfall from about 2034.

“Upgraded forecasts show that the world will need more gas for power generation, heating and cooling, industry and transport to meet development and decarbonisation goals,” says Tom Summers, Senior Vice President for Shell LNG Marketing and Trading. “LNG will continue to be a fuel of choice because it’s a reliable, flexible and adaptable way to meet growing global energy demand.”

China is significantly increasing its LNG import capacity and aims to add piped gas connections for 150 million people by 2030 to meet increasing demand. India is also moving ahead with building natural gas infrastructure and adding gas connections to 30 million people over the next five years.

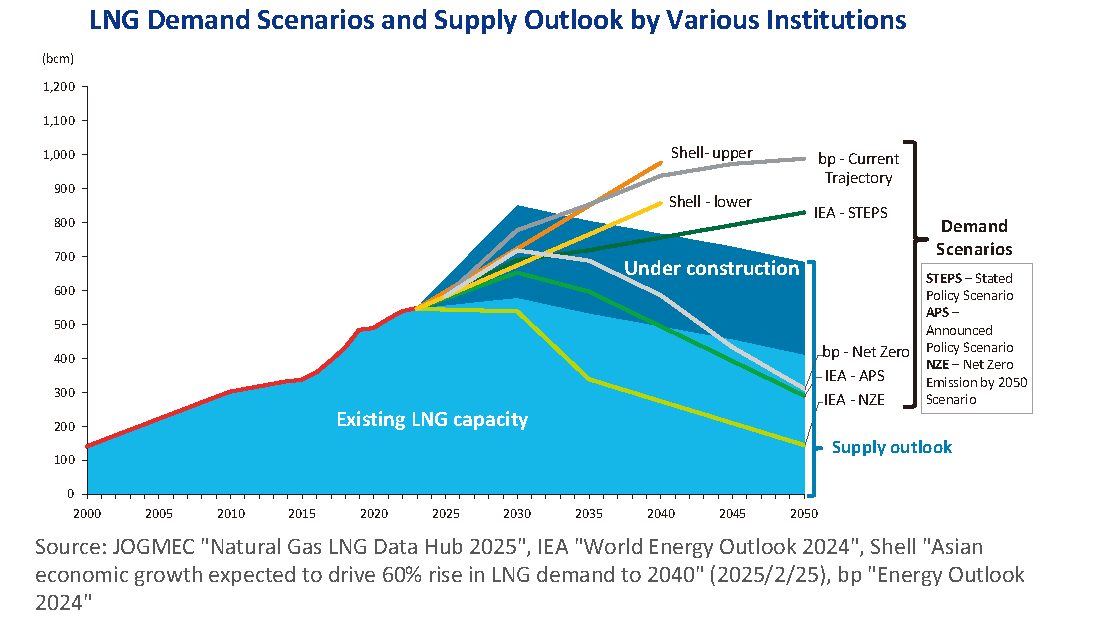

At the 2025 LNG Producer-Consumer Conference the Japanese Ministry of Economy, Trade and Industry (METI) stated LNG supply is expected to broadly align with demand scenarios projected by various institutions through the early 2030s. However, under high-demand scenarios, supply could become tight in the latter half of the 2030s (refer to chart above, right). On the supply side, projections are subject to significant uncertainty in the energy market, with the realization of planned and future LNG projects dependent on investment profitability and access to financing. On the demand side, particularly in emerging economies across Asia, it is important to recognize that demand levels may fluctuate depending on gas price trends, as these economies continue to grow. Under various Net-Zero scenarios an LNG surplus is forecast, but current evidence strongly suggests that the world will fall well short of Net-Zero by 2050, given the huge investments required and the potentially negative economic consequences on the way to getting there.

In the METI’s view, economic growth is expected to drive a continued increase in energy demand, and natural gas, including LNG, is anticipated to play an important role in meeting this growth. Gas-fired power plants contribute to power system stability by balancing the intermittency associated with the expansion of renewable energy. Additionally, as gas-fired generation emits fewer greenhouse gases than coal, fuel switching can support emissions reductions. Moreover, existing gas and LNG infrastructure can be repurposed for emerging low-carbon fuels such as biogas, e-methane, hydrogen, and ammonia, offering further decarbonization potential across the energy value chain. As such, LNG is expected to retain an important role during the energy transition.

Investment in upstream natural gas assets declined between 2015 and around 2020. This was due to a combination of factors, including the oil price decrease, policy and demand uncertainty following the Paris Agreement, increasingly stringent regulations on upstream oil and gas investments, and a strategic shift among energy companies toward renewables. Additionally, energy companies with high leverage suffered from the sharp decline in oil prices. However, since 2021, heightened concerns over energy security, particularly following Russia’s invasion of Ukraine, and the associated spike in commodity prices have reignited upstream investment. Investment in LNG liquefaction projects, which had been constrained during the oil price slump, surged in 2018–2019 in anticipation of the increase of oil price and demand recovery. In 2019, the volume of liquefaction capacity reaching final investment decision (FID) marked a record high. Since 2021, large-scale projects such as Rio Grande Phase 1, Port Arthur Phase 1, and Plaquemines Phase 2 in the United States, and the North Field expansion in Qatar, have also reached FID, pushing liquefaction investment volumes upward.

Remarkably, Australia has not played a major role in this LNG investment surge.

Natural gas is essential for the global energy transition, as evidenced by growing LNG demand

Since the outbreak of the conflict in Ukraine, European and Asian countries more than most have recognized that they must reduce reliance on any one region or country’s supply of energy including natural gas.

Natural gas is both a transition and a destination fuel. Natural gas and LNG are essential for the energy transition as they play an instrumental role in shifting away from coal and moving toward net-zero emissions. As the transition evolves, natural gas will remain vital in providing reliable and efficient energy to support economies in different parts of the world including Australia and all of Asia.

The re-drawing of global energy supply maps is pushing natural gas and LNG demand to new heights and spurring new off-take contracting and other activities and opportunities for companies like Gulf Energy, for example:

Oil major Shell (SHEL.L), and Japanese conglomerate Mitsubishi Corp (8058.T), are exploring sale options for their respective stakes in the C$40 billion ($28.8 billion) LNG Canada project. (Reuters, 17 January 2026)

Singapore has opened applications for new licenses to supply liquefied natural gas (LNG) as a marine fuel at the Port of Singapore. (Rigzone, 16 January 2026)

Texas LNG Brownsville LLC, part of Glenfarne Group LLC, has signed a definitive 20-year agreement with RWE Supply & Trading for the supply of 1 million tonnes/year (tpy) of LNG from the 4-million tpy Texas LNG export plant to be constructed in the Port of Brownsville, Tex. (Oil & Gas Journal, 16 January 2026)

JERA Co Inc and Woodside Energy Group Ltd have finalized an agreement for the Australian company to export liquefied natural gas (LNG) to the Japanese power utility in the winter months for five years. (Rigzone, 15 January 2026)

Saudi Aramco (2223.SE), and Commonwealth LNG have signed a long-term contract for the U.S. LNG developer to supply the world's largest oil exporter with 1 million metric tonnes per annum (mtpa). (Reuters, 15 January 2026)

MidOcean Energy LLC, a liquefied natural gas company founded by EIG, is in talks to join Argentina's signature LNG venture, according to people familiar with the matter. The $20 billion project led by state-run YPF SA and Italy's Eni SpA envisages construction of at least two floating liquefaction vessels with annual capacity for 12 million tons off Argentina's Atlantic coast. (Rigzone, 15 January 2026)

Mozambican President Daniel Chapo expects TotalEnergies SE’s $20 billion liquefied natural gas project to restart as early as this month, reviving a potentially key revenue source for the cash-strapped government. (Rigzone, 15 January 2026)

RWE Supply & Trading, and Texas LNG Brownsville LLC, part of Glenfarne Group, LLC (Glenfarne), have signed a 20-year sales and purchase agreement for one million tonnes per annum (MTPA) of liquefied natural gas (LNG). This corresponds to approximately 13 cargoes of LNG and approximately 1.4 billion cubic meters (BCM) per year of natural gas respectively. (RWE, 15 January 2025)

Gulf Development Public Company Ltd has signed a long-term LNG sales and purchase agreement (SPA) with ENGIE. This 15-year strategic partnership is designed to reinforce Thailand's energy supply chain and ensure long-term stability for the Thailand’s power sector. (LNG Industry, 14 January 2026)

Coastal Bend LNG has let a contract to KBR Inc. and Técnicas Reunidas for the front-end engineering and design (FEED) of its planned 22.5 million tonnes/year (tpy) natural gas liquefaction and export plant on the Texas Gulf Coast. (Oil & Gas Journal, 14 January 2026)

Woodside Energy Group Ltd. received the floating production unit (FPU) at Scarborough gas field 375 km off the coast of Karratha, Western Australia. The FPU will process gas at the field. The unit is about 70,000 tonnes and completed its journey from China to Australia after being towed more than 4,000 nautical miles. (Oil & Gas Journal, 14 January 2026)

Glenfarne Alaska LNG, a subsidiary of Glenfarne Group, has set the wheels in motion to secure a new deal for its liquefied natural gas (LNG) export development in Alaska by signing a non-binding letter of intent (LOI) with Donlin Gold, the developer of a mine with the same name owned by NOVAGOLD RESOURCES and Paulson Advisers. (Offshore Energy, 8 January 2026)

Commonwealth LNG main contractor Technip Energies NV has tapped Honeywell International Inc for integrated liquefied natural gas pretreatment and liquefaction solutions for the Louisiana project. (Rigzone, 8 January 2026)

QatarEnergy said Sunday it had signed a deal with Egyptian Natural Gas Holding Co to supply up to 24 cargos of liquefied natural gas (LNG) to the North African country for summer 2026. (Rigzone, 5 January 2026)

Natural gas is set to drive Africa’s next energy growth phase, with sub-Saharan Africa—rather than traditional hubs like Egypt and Algeria—expected to deliver most of the continent’s future gas and LNG expansion. LNG exports from sub-Saharan Africa are forecast to jump ~175% by 2034. Reforms and major FIDs are unlocking investment, with Nigeria securing over $8 billion in gas project approvals, Mozambique restarting stalled mega-projects, and Tanzania moving closer to a final investment decision that could reshape its economy. (OilPrice.com, 3 January 2026)

U.S. liquefied natural gas exports set new records in 2025 as new capacity came online and existing terminals ran at high utilization, pushing annual shipments past levels previously thought years away. Preliminary data from LSEG show the United States exported 111 million metric tons of LNG last year, making it the first country to surpass the 100-million-ton threshold in a single year. That volume puts U.S. exports nearly 20 million tons ahead of Qatar and about 23 million tons above 2024 levels, reinforcing the country’s position as the world’s largest LNG supplier. (OilPrice.com, 2 January 2026)

Russia’s Novatek exported 21 cargoes of liquefied natural gas to China from its Arctic LNG 2 facility last year, data from Kpler cited by Reuters has shown. Arctic LNG 2 is under EU and U.S. sanctions. (OilPrice.com, 2 January 2026)

With energy security still at the forefront, several liquefied natural gas (LNG) projects have been given the green light to proceed to production mode across the globe, with the United States (U.S.) running the show. As a result, 2025 marked the start of the next wave of LNG projects that are anticipated to enrich the global energy mix. (Offshore Energy, 1 January 2026)

See past activities and opportunities for companies like Gulf Energy below:

Future global LNG demand will come mainly from Asia, and the Bamaga Basin (Q/23P) is ideally located to supply that market

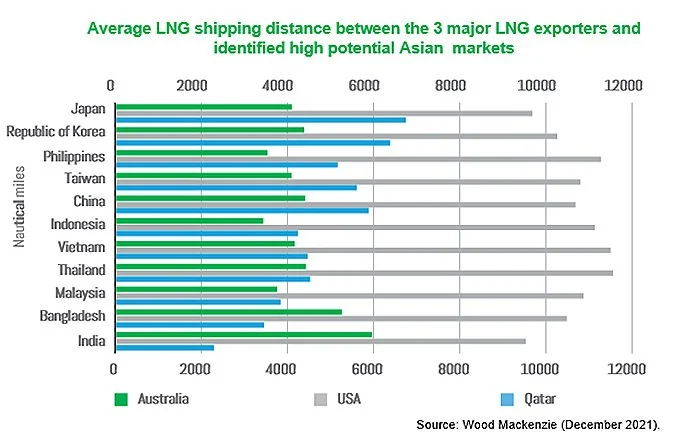

Australia is ‘location competitive’ for much of Asia

Asia’s demand for LNG is forecast to surge, but Australia hasn’t found and developed enough new gas to remain a major global LNG supplier

Australia is closer to most high potential Asian markets than its biggest LNG exporting competitors, Qatar and the USA.

Australia has failed to maintain a steady stream of new gas production projects being brought online.

More than $200 billion of LNG projects were approved for final investment decisions (FIDs) in Australia before 2012. Since then, the Woodside Scarborough Project (Pluto Train 2 Expansion) and the Santos Barossa Project are the only LNG projects to reach FID, with the latter being primarily a backfill project to extend the life of the Darwin LNG facility.

Without further investment in new LNG trains and upstream infrastructure, Australia will lose its position as a major LNG exporter and will almost certainly lose its energy security.