Global LNG demand is increasing

McKinsey has researched the global outlook for gas to 2050 and has determined that gas is the only fossil fuel expected to grow beyond 2030, peaking and plateauing from 2037. From 2035 to 2050, gas demand is forecast to decline by only 0.4 percent. This relatively moderate decline is due to hard-to-replace gas use in the chemical and industrial sectors, which limits the impact of an accelerating decline in gas used for power.

What is concerning to future global demand is the additional supply required to be discovered and/or reach FID (Final Investment Decision) from 2027 onward. It’s not just McKinsey saying the world has a massive future LNG deficiency problem, but also others including BP, Shell and Wood McKenzie. In BP’s Energy Outlook 2023, chief economist Spencer Dale, said investment in upstream production would be needed until 2050 to ensure supply matched demand. “Natural declines in existing production sources mean there needs to be continuing upstream investment in oil and natural gas over the next 30 years,” he wrote in the report.

Natural gas and LNG are essential for the global energy transition, as evidenced by growing long-term supply contracts

Since the outbreak of the conflict in Ukraine, European and Asian countries more than most have recognized that they must reduce reliance on any one region or country’s supply of energy including natural gas.

Natural gas is both a transition and a destination fuel. Natural gas and LNG are essential for the energy transition as they play an instrumental role in shifting away from coal and moving toward net-zero emissions. As the transition evolves, natural gas will remain vital in providing reliable and efficient energy to support economies in different parts of the world including Australia and all of Asia.

The re-drawing of global energy supply maps is pushing natural gas and LNG demand to new heights and spurring new off-take contracting and other activities and opportunities for companies like Gulf Energy, for example:

State-owned China Resources Gas International Ltd. has contracted Woodside Energy Group Ltd. for the supply of 600,000 metric tons per annum of liquefied natural gas (LNG) to China over 15 years. (Rigzone, 17 March 2025)

Venture Global LNG Inc. has taken final investment decision (FID) on Phase 2 of its 20-million tonne/year (tpy) Plaquemines LNG plant in Plaquemines Parish, La. Accordingly, the company also issued a full notice to continue with Phase 2 construction to contractors KZJV LLC, a joint venture of Zachary Group and KBR Inc. (Oil & Gas Journal, 15 March 2025)

Naftogaz Group and ORLEN SA have signed a memorandum of cooperation in the liquefied natural gas (LNG) sector to help Ukraine diversify its energy supply. The first act of the agreement will be the sale by ORLEN of about 100 million cubic meters (3.53 billion cubic feet) of gas derived from the regasification of an LNG cargo. (Rigzone, 11 March 2025)

The United States Department of Energy (DOE) on Monday granted a five-year deadline extension for Delfin LNG LLC to begin exports under its non-FTA permit. (Rigzone, 11 March 2025)

Venture Global said it is expanding its Plaquemines LNG project in Louisiana with 24 trains and is planning to invest an additional $18 billion. The investment would bring its total investment in its current and planned U.S. projects to more than $75 billion. (Rigzone, 10 March 2025)

The United States’ share of the world’s liquefied natural gas (LNG) trade is regaining momentum at a pace that could reach one-third of global demand, or two times the consumption of Japan and South Korea combined, by 2035, Shell PLC projects. (Rigzone, 4 March 2025)

Annual global gas demand saw a 700 billion cubic meters (bcm) surge over the past decade at a 1.8% compound annual growth rate (CAGR) and the global gas demand increased around 2.5% in 2024 despite limited new LNG supplies. (Offshore Energy, 4 March 2025)

In a statement posted on its website recently, ADNOC announced that it has signed a sales and purchase agreement (SPA) with Osaka Gas for the supply of up to 0.8 million tons per annum of liquefied natural gas (LNG). (Rigzone, 3 March 2025)

NextDecade Corp. has begun development of three additional trains for its Rio Grande LNG liquefaction plant on the north shore of the Brownsville Ship Channel in south Texas, bringing its total planned capacity to 45 million tonnes/year (tpy). (Oil & Gas Journal, 1 March 2025)

In a BMI report sent to Rigzone by the Fitch Group, analyst at BMI, a unit of Fitch Solutions, said “leading energy companies, such as BP, Shell, TotalEnergies, and Equinor” are “holding back renewables commitments to secure higher short-term return” but warned that a “bearish oil and gas price outlook will squeeze profit margins”. (Rigzone, 26 February 2025)

Global demand for liquefied natural gas (LNG) is projected to increase by around 60% by 2040, driven by economic expansion in Asia, emissions reduction efforts in heavy industry and transportation, and the growing impact of artificial intelligence, according to Shell’s LNG Outlook 2025. Industry forecasts now anticipate LNG demand to reach 630-718 million tons/year (tpy) by 2040, reflecting an upward revision from previous estimates. (Oil & Gas Journal, 25 February 2025)

For the first time since taking the reins, Chief Executive Officer Murray Auchincloss will lay out his new vision, with the stakes high after Elliott Investment Management bought up about 5% of the company in order to push for big changes. (Rigzone, 25 February 2025)

Woodside Energy Group Ltd. is preparing to give the go-ahead for its Louisiana LNG project as Australia’s biggest natural gas producer looks beyond its core markets in Asia. (Rigzone, 25 February 2025)

Venture Global LNG Inc. has taken final investment decision (FID) on Phase 2 of its 20-million tonne/year (tpy) Plaquemines LNG plant in Plaquemines Parish, La. Accordingly, the company also issued a full notice to continue with Phase 2 construction to contractors KZJV LLC, a joint venture of Zachary Group and KBR Inc. (Oil & Gas Journal, 24 February 2025)

Centrica said it has secured a sale and purchase agreement to provide liquefied natural gas (LNG) to Petróleo Brasileiro S.A (Petrobras). The contract between the two companies is for the purchase of 0.8 million tons per annum (mtpa) of LNG for 15 years, beginning in 2027. (Rigzone, 24 February 2025)

Cheniere Energy Inc. has produced the first liquefied natural gas (LNG) cargo from a project expanding the Corpus Christi LNG (CCL) terminal in the namesake Texan city. CCL Stage 3 has seven midscale trains with an expected production capacity of over 10 million metric tons per annum (MMtpa), raising CCL’s output capacity to over 25 MMtpa from 10 trains. (Rigzone, 21 February 2025)

Tokyo Gas Co. Ltd. has acquired a 20 percent stake in FGEN LNG Corp., which owns one of two operational liquefied natural gas (LNG) receiving terminals in the Philippines. (Rigzone, 19 February 2025)

Egypt and Cyprus on Monday signed deals for the reexport and commercialization of Cypriot gas, agreements that are key for Cairo in its push to become a regional energy exporter as its own output suffered declines in the past couple of years. (Rigzone, 17 February 2025)

TotalEnergies SE has closed a long-term deal to supply India’s state-owned Gujarat State Petroleum Corporation Limited (GSPC), with 400,000 tons of liquefied natural gas (LNG), amounting to six cargoes per year. (Rigzone, 17 February 2025)

ADNOC Gas plc signed a 14-year agreement to supply LNG to Indian Oil Corp. Ltd. The SPA delivery of 1.2 million tonnes/year (tpy) LNG sourced from the Das Island liquefaction plant which has a production capacity of up to 6 million tpy. (Oil & Gas Journal, 14 February 2025)

TotalEnergies signed a long-term agreement to supply state-owned Gujarat State Petroleum Corp. Ltd. (GSPC) with 400,000 tonnes/year of LNG, amounting to six cargoes per year. (Oil & Gas, 13 February 2025)

A BP PLC-operated liquefied natural gas (LNG) project in Western Africa is expected to dispatch its first cargo by March. On January 2 BP said gas had started flowing from wells in the Greater Tortue Ahmeyim (GTA) field on the maritime border of Mauritania and Senegal to the GTA floating production, storage and offloading (FPSO) vessel as part of the commissioning process. Located about 40 kilometers (24.85 miles) offshore, the FPSO removes water, condensate and impurities from the gas then sends it via pipeline to a floating liquefaction vessel situated 10 kilometers offshore. (Rigzone, 10 February 2025)

A groundbreaking ceremony has been held for five mini-liquefied natural gas (LNG) facilities in the Nigerian state of Kogi. NNPC holds stakes in three of the projects: 90 percent in Prime LNG, 50 percent in NGML/Gasnexus LNG and 10 percent in BUA LNG. The other two plants are LNG Arete and Highland LNG. The five will rise in the town of Ajaokuta. (Rigzone, 3 February 2025)

Argent LNG LLC signed a heads of agreement (HoA) with the Government of Bangladesh for supply of up to 5 million tonnes/year (tpy) of LNG. Argent LNG aims to build and operate a mid-sized onshore LNG export project with up to 12 LNG trains with a combined capacity of 25 million tpy. (Oil & Gas Journal, 28 January 2025)

ADNOC Gas PLC has won a $450 million (AED 1.653 billion) contract to deliver liquefied natural gas (LNG) to Japan for three years. The order was placed by JERA Global Markets Pte. Ltd., owned 66.7 percent by Japanese power utility JERA Co. Inc. and 33.3 percent by France’s EDF Trading Ltd. (Rigzone, 27 January 2025)

See past activities and opportunities for companies like Gulf Energy below:

Most of the future global LNG demand will come from Asia

Australia is ‘Location Competitive’ for much of Asia

The high potential Asian market for LNG is forecast to double, but Australia hasn’t found or developed enough new gas to meet the predicted demand

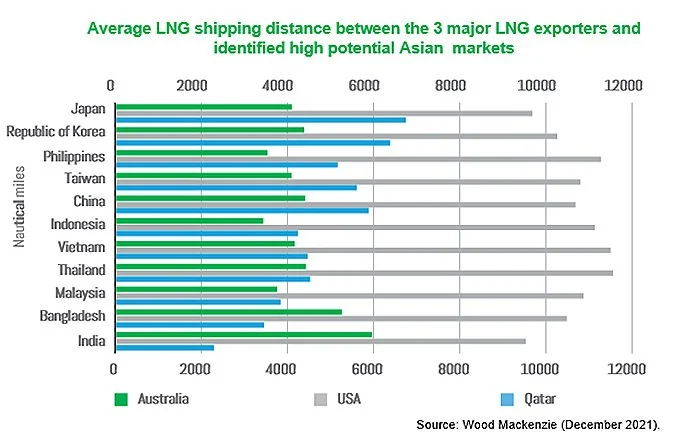

Australia is closer to most high potential Asian markets than its closest LNG exporting competitors, Qatar and the USA.

Australia has failed to maintain a steady stream of new gas production projects being brought online.

More than $200 billion of LNG projects were approved for final investment decisions (FIDs) in Australia before 2012. Since then, Woodside’s Scarborough project is the only LNG capacity project to reach FID (in November 2021).

Without further investment in new LNG trains and upstream infrastructure, Australia may lose its position as a major LNG exporter and will almost certainly lose its energy security.